Serious Fraud Office

Featured

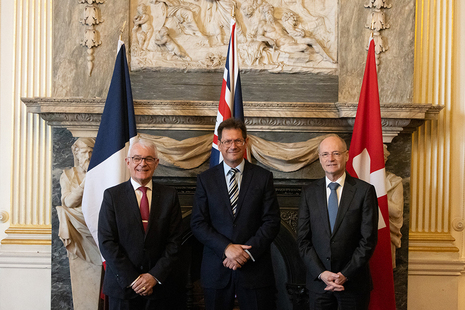

UK, France and Switzerland announce new alliance to tackle bribery and corruption threat

Initial findings of our e-discovery review

News story

Our Interim Director of Legal Services Matthew Wagstaff provides an update on our ongoing review of our use of e-discovery software.

Today the SFO secured its first UWO as it seeks to recover a Lake District property believed to have been purchased with the proceeds of a £100m fraud.

The SFO has published its plan for the year ahead focusing on using new tools, enhancing its intelligence capacity and with domestic and international partners.

Our cases

Service

Find fraud, bribery and corruption cases investigated by the SFO.

Proceeds of Crime

Manual

Our work goes beyond securing convictions for fraud, bribery or corruption. We also pursue the proceeds of crime.

Latest from the Serious Fraud Office

What we do

The Serious Fraud Office (SFO) fights complex financial crime, delivers justice for victims and protects the UK’s reputation as a safe place to do business.

SFO is a non-ministerial department.

Follow us

Documents

Transparency and freedom of information releases

Our management

Contact SFO

Office address

London

SW1Y 5BS

United Kingdom

Telephone

020 7239 7272

For journalists with a news related enquiry please contact news@sfo.gov.uk or +44 (0)7557 009842.

You can find content prior to 1 December 2024 at The National Archives. https://webarchive.nationalarchives.gov.uk/ukgwa/20241119154227/https://www.sfo.gov.uk/

Make an FOI request

- Read about the Freedom of Information (FOI) Act and how to make a request.

- Check our previous releases to see if we’ve already answered your question.

- Make a new request by contacting us using the details below.

Freedom of Information

2-4 Cockspur Street

London

SW1Y 5BS

United Kingdom