Investment manager behind £100 million no-win-no-fee fraud jailed for 14 years

11 August, 2022 | News Releases

Following a successful investigation and prosecution by the Serious Fraud Office (SFO), Timothy Schools, the investment manager who used millions of pounds of investors’ money to fund his luxury lifestyle, has been sentenced to 14 years in prison, in a hearing at Southwark Crown Court today.

On Tuesday, Schools (61), the investment manager for the Cayman Island-based Axiom Legal Financing Fund, was convicted by a jury on 5 counts of fraudulent trading, fraud by abuse of position and money laundering.

The fraud

The Axiom Fund was set up in 2009 by Mr Schools to provide loans to law firms pursuing no-win-no-fee cases. The Axiom Fund secured over £100 million from approximately 500 investors, who were promised a secure return on their investment.

Whilst investors were told their loans would be provided to a panel of high quality law firms to fund legal cases with a high likelihood of success, the majority of the funds (amounting to £40 million) were paid to just three law firms – ATM, Ashton Fox and Bracewell’s – all of which Mr Schools either owned or held undisclosed interest in.

The loans provided to these law firms were siphoned off by Mr Schools. He used funds received by ATM Solicitors to pay himself over £1 million in salary, consultancy fees and other personal benefits.

The cases Axiom funded were not independently vetted, often failed at court and case insurance policies failed to pay out when cases did not succeed. Mr Schools covered up these failures by arranging for the repayments of old loans with new Axiom loans. This gave the false impression to directors, administrators and auditors that law firms were successfully repaying their loans and achieving returns on investment.

The number of clients whose cases were affected by the fraud is in the range of 35,000.

Financial benefits

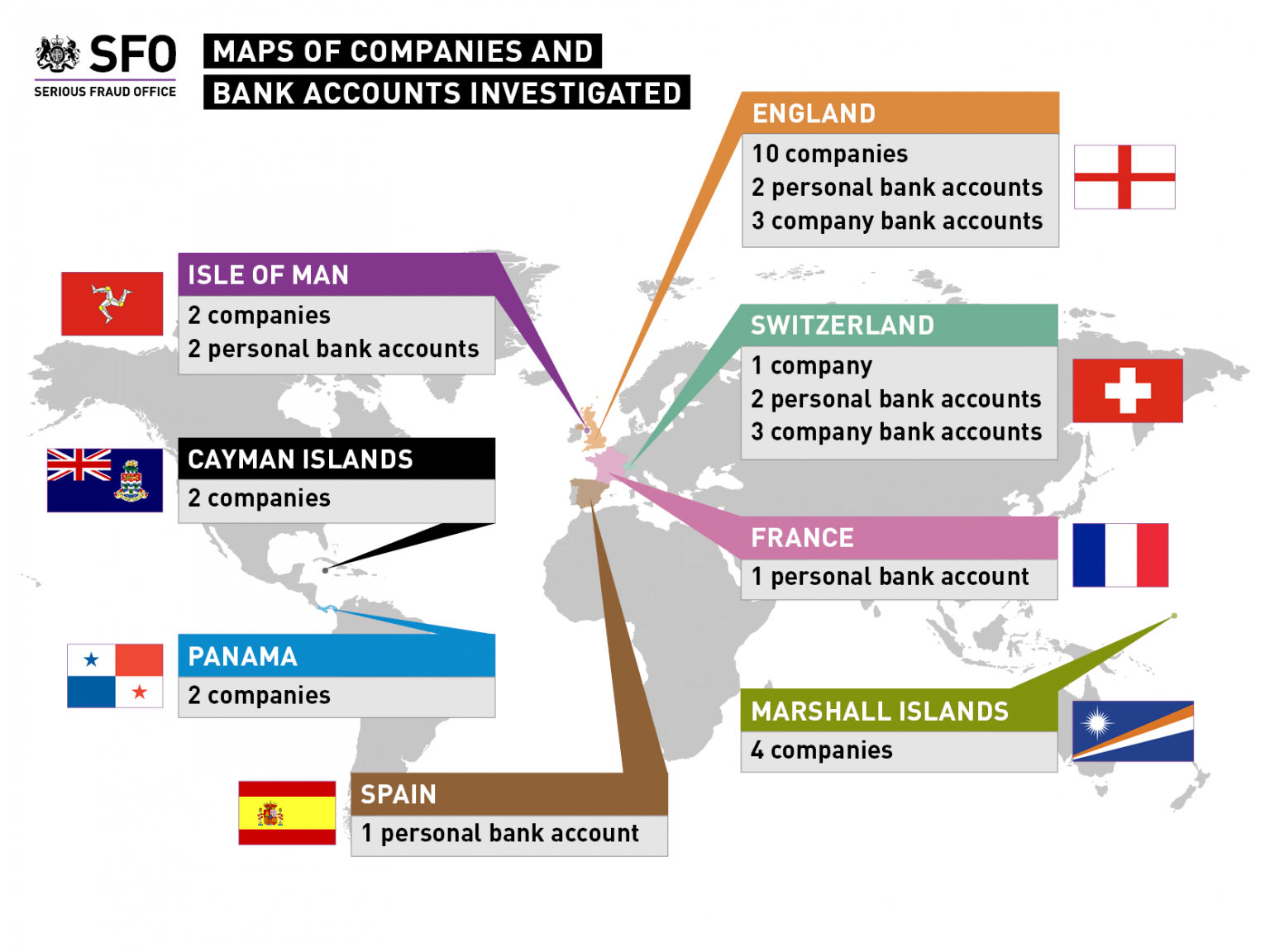

The SFO investigation found Mr Schools dishonestly acquired over £19.6 million from the Axiom loan monies, including more than £5.7 million from audit and management fees he dishonestly added to the law firm loans. The monies were transferred and hidden in offshore bank accounts held within complex overseas trusts, and used to finance a lifestyle that included the purchase of shares in a luxury ski hotel in France, a motor boat, luxury cars and a £5 million fishing and shooting estate in the Lake District, bought through an offshore company.

Lisa Osofsky, Director, Serious Fraud Office, said: “Mr Schools deliberately abused his position of trust to enrich himself. Through a complex web of lies, he attempted to hide his fraudulent activity, while spending other people’s hard earned money.”