Annual Report and Accounts 2020-2021

| File | Action |

|---|---|

| SFO annual report and accounts 2020-2021.pdf | Download |

Serious Fraud Office

Annual Report and Accounts 2020-21

(For the year ended 31 March 2021)

Accounts presented to the House of Commons pursuant to Section 6(4) of the Government Resources and Accounts Act 2000

Annual Report presented to Parliament pursuant to Section 1(15) and Paragraph 3 of Schedule 1 to the Criminal Justice Act 1987

Accounts presented to the House of Lords by Command of Her Majesty

Ordered by the House of Commons to be printed on 15 July 2021

© Crown copyright 2021

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit

nationalarchives.gov.uk/doc/open-government-licence/version/3.

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available on our website at: www.sfo.gov.uk/publications/

Any enquiries regarding this publication should be sent to us at 2-4 Cockspur Street, SW1Y 5BS.

ISBN 978-1-5286-2577-7

CCS0421474562 07/21

HC 578

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit

nationalarchives.gov.uk/doc/open-government-licence/version/3.

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

Any enquiries regarding this publication should be sent to us at 2-4 Cockspur Street, SW1Y 5BS.

ISBN 978-1-5286-2577-7

CCS0421474562 07/21

Statement from the Director

I am pleased to present the Annual Report and Accounts for the Serious Fraud Office for the reporting year 2020-21.

The Serious Fraud Office (SFO) exists to fight serious financial crime, to deliver justice to victims and to protect the UK’s reputation as a safe place to do business. This is a noble mission and one that I am deeply proud to be part of. This Annual Report and Accounts for 2020-21 demonstrate the SFO’s results and the progress we are making in many areas in order to realise our ambitions for the organisation, not only in terms of our operations but also in our culture and ways of working.

2020-21 was, in many ways, dominated by the wide-ranging impacts of the Covid-19 pandemic. It has been inspiring to see how well the SFO, UK law enforcement and the courts have responded so that we can continue to investigate and, where appropriate, prosecute serious and complex fraud, bribery and corruption. For the SFO this meant changing how we operate, with most staff working remotely, and adapting our practices and IT infrastructure to enable us to connect and collaborate with our partners in the UK and across the globe to progress our cases. The positive way in which the organisation responded to Covid-19 was highlighted by Her Majesty’s Crown Prosecution Service Inspectorate (HMCPSI) in 2020. We continued to adjust and to adapt throughout the year, whilst maintaining focus and energy to deliver our goals.

Our people remain the SFO’s most important asset. In 2020-21, we continued to strengthen our organisation and the experience of our staff through the Culture Change Programme, which was started in July 2019. This vitally important programme of work is ensuring the SFO’s leadership behaviours and working culture make all staff feel valued as part of an inclusive workplace. In this reporting year, I am delighted to report that we have had an increase in Staff Survey scores in leadership and change, pay and benefits and my work. This shows that the programme is delivering and that our culture is improving, thanks to the dedication, mutual support and resilience of SFO staff.

The SFO’s operational impact has been strong this year. We successfully prosecuted four individuals and corporates, opened eight new criminal investigations, and charged 20 individuals and corporates. The convictions of former Unaoil executives and further guilty pleas in the Petrofac case, all related to bribery connected to the oil industry, demonstrate the quality of our investigations. Our ability to deliver justice is also evident in our use of Deferred Prosecution Agreements (DPAs), through which since 2014 the SFO has been able to secure cooperation of businesses who admit wrongdoing, pay for that wrongdoing and commit to improving their corporate governance. Since 2014, SFO DPAs have delivered £1.6bn to the public purse. In 2020-21 we secured two DPAs: with G4S Care & Justice Services Ltd, which involved a financial penalty and reimbursement of SFO costs totalling £44.4m; and with Airline Services Ltd which resulted in a payment of £2.98m including the SFO’s costs.

The SFO returns a significant amount of the money we recover from criminals in our cases to victims through compensation payments. It is a key part of our strategic objectives to ensure that the needs of victims are at the heart of what we do and are considered throughout the life of a case. In 2020-21 our Proceeds of Crime Division (POCD) secured over £7.4m in new financial orders made against criminals convicted in SFO cases, and received payments relating to outstanding orders of more than £6.9m.

For the year ahead, I anticipate that the environment for law enforcement will continue to be demanding. The SFO will rise to the challenges ahead, and we will continue to learn from mistakes as well as successes. We are doing just that in relation to the disclosure challenges in the trial of former employees of Serco, which led in April this year to the judge directing the jury to offer verdicts of not guilty. This learning includes an independent review we have commissioned to ensure we fully understand the facts and can take whatever action is necessary to address any shortcomings.

I will also continue to champion the work that the SFO does, to highlight our record of success and to invest in our future capability. A challenging economic situation has historically opened opportunities for ever-more innovative and ruthless criminality. The SFO is already adapting to the changing threat picture and will continue to make good use of public money to deliver our important mission.

Lisa Osofsky

Director

Serious Fraud Office

9 July 2021

Performance Overview

SFO at a glance

01 April 2020 to 31 March 2021

Statement of Purpose and Activities

The Serious Fraud Office (SFO) is a non-ministerial department headed by the Director. It also forms one of the Law Officers’ Departments and, as such, constitutes a public arm’s length body sponsored by the Attorney General’s Office. A Framework Agreement sets out the relationship between the Law Officers and the Director of the SFO.

The SFO was established by the Criminal Justice Act (CJA) 1987 and commenced operations in 1988. It is part of the UK criminal justice system covering England, Wales and Northern Ireland, but not Scotland, the Isle of Man or the Channel Islands.

SFO’s purpose

The SFO’s purpose is to investigate complex financial crime and, where appropriate, prosecute cases of serious or complex fraud, bribery and corruption. In addition, the SFO recovers the proceeds of those crimes it investigates and assists overseas jurisdictions in their investigations into serious or complex fraud, bribery and corruption. We uphold the rule of law and deliver justice for victims.

The SFO has unique powers under section 2 of the Criminal Justice Act 1987 to require attendance at interview or the production of information or, in certain circumstances, to apply for a warrant to enter and search premises to take possession of information. The SFO has multi-disciplinary case teams of lawyers, investigators, forensic accountants, external counsel and other experts, led by a case controller. This joint investigatory prosecutorial case-team structure is known as the ‘Roskill’ model.

The SFO will investigate those cases which call for the legal powers and multi-disciplinary approach available to the SFO. In considering whether to take on an investigation, the Director applies a Statement of Principle. This Statement provides further guidance on the cases the Director will accept for investigation, and to emphasise the relevance of the SFO’s specific powers and multi-disciplinary structure (the Roskill Model).

The Statement of Principle is as follows:

The Director may investigate any suspected offence which appears to her on reasonable grounds to involve serious or complex fraud.

In considering whether to authorise an investigation the Director will take into account the actual or intended harm that may be caused to:

- the public, or

- the global reputation and integrity of the UK as an international financial centre and as a safe place to invest and do business, or

- the economy and prosperity of the UK;

and whether the complexity and nature of the suspected offence warrants the application of the SFO’s specialist skills, powers and capabilities to investigate and prosecute.

SFO’s Strategic objectives

To support this, the SFO had five strategic objectives covering 2020-21:

- Investigate and, if appropriate, prosecute serious or complex fraud, bribery and corruption cases and associated money laundering fairly and effectively;

- Recover the proceeds of serious or complex fraud fairly and effectively;

- Develop, and strengthen, constructive relationships with partners both in the UK and internationally;

- Build an effective workforce, treating our staff fairly and with respect and dignity; and,

- Provide value for money in everything we do.

SFO’s values

We live by a set of shared values that we expect from each other and that anyone we engage with can expect from us:

Integrity and professionalism - we make objective decisions whilst always mindful of quality and value for money;

Openness and transparency - we share information with each other and, where appropriate, others; explaining our decisions and learning from our mistakes;

Respect - we show respect to one another, to our external colleagues and to the wider public; and,

Excellence - we strive for excellence in all that we do.

SFO’s principal risks as at 31 March 2021

|

Cause - An element which has the potential to give rise to risk |

Event – An occurrence or change of a set of circumstances |

Consequence – the outcome of an event affecting objectives |

|

Operational: - Not following/understanding end to end policies, procedures and processes or applying the law correctly and management oversight not identifying issues. - Policies, procedures and processes are not fit for purpose. |

Not identifying, accepting, progressing or successfully delivering and prosecuting cases or other disposals (incl DPAs and proceeds of crime). |

Reputational damage to the SFO and wider prosecution organisations and financial implications (immediate in costs awards but also undermines HMT confidence for the purpose of SRs). |

|

People: Staff not having requisite skills, capabilities and confidence to undertake work. |

Operational failure due to being unable to deliver the business/work to the expected standard. |

Reputational damage to the SFO and financial implications. |

|

People: Inefficient and ineffective management of functions. |

Ineffective and inefficient operational delivery due to lack of clarity regarding what staff should be doing. Unmotivated and un-resilient workforce. |

Reputational damage to the SFO and potential financial implications. Loss of staff/capability (or inability to recruit) to deliver our mission. |

|

Strategy: - SFO not considered a priority amongst key policy and legislative stakeholders. - Lack of awareness about the SFO to be considered a priority. |

Failure to engage with key policy influencers and legislators on relevant issues. |

Sub-optimal legislative environment for SFO cases. Loss of confidence in our ability and reputation impact. |

|

Technology: Inadequate cyber security including: - Unpatched vulnerabilities or system misconfiguration - Inadequate cyber security behaviours, processes and practices - Inadequate incident detection and response capability. |

Successful cyber-attack against SFO systems and data. |

Confidentiality, integrity or availability of information is compromised leading to potential legal, financial or reputational damage. |

|

Technology: Inadequate IT systems - resilience and Disaster Recovery planning and response. |

Prolonged loss of access to some or all of SFO’s IT systems, with potential loss of data. eg: - An externally driven failure such as fire, flood or cyber-attack - An internally driven failure such as software or hardware malfunction. |

Delayed or abandoned case progression leading to legal, financial and reputational damage. |

|

Information: Inadequate management of records and datasets, including: - Inappropriate use, unauthorised disclosure or loss of personal data - Unlawful retention of information beyond legal requirements - Inadequate behaviours to capture and track data appropriately. |

A data breach occurs (including data loss), data is unavailable when required, or cannot be processed in line with legislation including the UK Data Protection regime and the Public Records Act. |

Legal challenge, financial loss and/or reputational damage as a consequence of: - Delayed, or abandoned case progression - External audit and/or regulatory action (e.g. the ICO), including a fine up to £17.5m - Non-compliance with legislation. |

|

Information: Ineffective data collection - and analysis to progress cases swiftly. |

Strategy design (and evolution) and delivery performance reporting is inefficient and ineffective. |

Financial and reputational damage. |

|

Legal: Legal action taken against the SFO. |

Legal action in relation to: - employment issues - casework related issues - loss of information/data |

Financial and reputational damage. |

|

Financial: Failure to consider, monitor and escalate potential financial cost and implications for wider budget. |

Unanticipated financial costs breaching budget limitations. |

Reprioritisation of wider organisational objectives due to reduced funding availability. |

Further information on how risks are managed can be found within the Governance Statement on

page 41.

Going concern basis

In common with other government departments, the future financing of the SFO’s liabilities is met by future grants of supply and the application of future income, both of which are to be approved by Parliament each year. The SFO has secured funding for the current financial year via Spending Review 2020 and will agree future funding as part of the Spending Review 2021 and in consequence there is no reason to believe that future approvals will not be forthcoming. It was therefore appropriate to prepare these financial statements on a going concern basis.

Summary of performance during the year

This year has been an unprecedented year for the SFO and we are proud of how we have responded to the challenges.

Our positive net financial impact is almost £1.3bn over the period 2016-17 to 2020-21. This means that over this period, the SFO’s contributions to Her Majesty’s Treasury are 4.2 times greater than our cost to the taxpayer.

We continue to demonstrate our commitment to victims. Part of this commitment is in recovering the proceeds of crime and compensating victims. This year our Proceeds of Crime Division recovered over £220k in compensation, all of which will be paid to victims.

Our successes against our Business Plan include:

Operations

Throughout the year the SFO continued to use the full range of tools and orders to investigate and prosecute our cases and recover the proceeds of crime. This year we have secured:

- Four convictions of individuals. Four individuals were sentenced: three were sentenced from convictions obtained this year and one individual sentenced from a conviction obtained in the previous year, with a combined sentencing imposed of 14 years and 10 months of imprisonment.

- Two DPAs resulting in over £47m in fines, penalties and costs.

- 20 individuals and corporates charged (two against corporates were suspended due to entering DPAs with the SFO). These trials will take place in 2021-22 and 2022-23.

- Over £220,000 in compensation for victims.

People

The SFO has adjusted rapidly to working remotely for the majority of its workforce. This has brought benefits and challenges for our people and we have paid particular attention on supporting the health and wellbeing of our workforce during this period and identifying the lasting impacts for our workforce planning for the future in the changing landscape of the workplace.

HMCPSI undertook an inspection of the SFO in July 2020. The findings recognised our commitment to supporting the health and wellbeing of our staff through regular, high quality and effective communication.

Our most recent civil service people survey, published in December 2020, showed an increase of 7% on leadership and managing change. We achieved a 16% increase from the previous year in our staff feeling that senior managers are sufficiently visible – a good achievement at any time but more notable as this covered the period of significant levels of remote working.

This year, 21 trainees graduated from our investigative trainee programme. The programme continues to generate significant interest demonstrated through over 2000 applicants applying, yielding strong competition throughout the recruitment process.

Stakeholders

We have maintained and built upon our relationships with stakeholders throughout the year especially with our key partners. We have collaborated with our Government partners, including the National Crime Agency’s National Economic Crime Centre (NECC). We contributed to a series of legislative and policy initiatives that affect the wider Criminal Justice System and help us secure the tools and powers for our casework.

Technology

The events of this year have highlighted and reinforced the importance of our digital, data and technology services which all of our staff rely on. We have been working to enhance our technology provision to meet the challenges of Covid-19 including introducing video conferencing technology and building the resilience of our network to support greater remote working. We have enabled our investigative work to continue during the pandemic by continuing to process digital material and evidence for our case teams.

...the SFO’s contributions to Her Majesty’s Treasury are 4.2 times greater than our cost to the taxpayer

Our performance this year

Whilst we had a number of successes in our casework during the year, we also encountered challenges. We will continue to learn from these events.

We successfully defended three grounds raised at the Divisional Court following Judicial Review launched by KBR Inc on the use of our Section 2 powers. Subsequently, KBR Inc sought only to appeal to the Supreme Court on only one of the three grounds. On 5th February 2021 the Supreme Court found against the SFO on this matter. This concerned the extraterritorial reach of our Section 2 powers to compel foreign companies to produce documents to the SFO which were held overseas. We will continue to use our strong international relationships and other existing tools such as Mutual Legal Assistance to secure crucial evidence for our cases. The SFO was liable to costs incurred by the prosecution of an estimated amount of £600,000.

In March 2021 the SFO received an adverse judgment at an employment tribunal bought by the former case controller on this investigation who had claimed unfair dismissal. The SFO is appealing this decision.

In July 2019 we entered into a DPA with Serco Geografix Limited, under which SGL paid a financial penalty of £19.2 million, and the full amount of the SFO’s investigative costs (£3.7m). This was in addition to the £12.8m compensation already paid by Serco to the MoJ as part of a £70m civil settlement in 2013. Two individuals were charged in December 2019 in connection with this case. Subsequently, on 26th April 2021 the SFO offered no evidence at their trial after a review of the disclosure process. The judge directed the jury to return verdicts of not guilty and the SFO accepted liability for reasonably wasted costs in respect of the trial. A full review and lessons learnt is being undertaken by a leading QC and remains at the forefront of implementing control procedures to ensure this is not repeated in the future.

Our casework

This year we have opened eight new criminal investigations including an investigation into a suspected fraudulent scheme operated by Raedex Consortium. We also publicly announced a further two ongoing investigations: We are investigating Bombardier Inc over suspected bribery and corruption in relation to contracts and/or orders from Garuda Indonesia; and, our investigation into Airline Services Limited which on 30 October 2020 resulted in a DPA.

We have charged 20 individuals and corporates, of which two charges against corporates were suspended due to entering a DPA. We have closed 12 criminal investigations without charge this year, of which nine had been open for over four years. 19 individuals and organisations were awaiting trial at the end of the year.

Highlights of our operational performance this year include:

- Obtaining the convictions of three individuals in July 2020 and February 2021, in addition to the guilty plea secured on a fourth individual in July 2019, as part of investigations into Unaoil executives’ corrupt payments for oil contracts in post-occupation Iraq. These investigations revealed $17 million worth of bribes to secure contracts worth $1.7 billion for Unaoil and its clients.

- Obtaining further convictions for additional bribery offences committed by a former senior Petrofac executive. These offences relate to corrupt offers and payments to influence the award of contracts in the United Arab Emirates worth approximately $3.3 billion. This guilty plea was in relation to their role in offering and making corrupt payments to agents to influence the awards of an engineering, procurement and construction contract to Petrofac in 2013 (and a variation to that contract awarded in 2014) on the Upper Zakum UZ750 Field Development Project, and a front-end engineering design contract awarded to Petrofac in 2014 on the Bab Integrated Facilities Project, each located in Abu Dhabi. Total payments of approximately $30 million were made, or were due to be made, by Petrofac to those agents in connection with these contracts.

- Entering into a DPA with G4S Care & Justice Services (UK) Ltd (G4S C&J). Under the terms of the DPA, G4S C&J accepted responsibility for three offences of fraud against the Ministry of Justice (MoJ). These offences arose from the scheme to deceive the MoJ as to the true extent of G4S C&J’s profits between 2011 and 2012 from its contracts for the provision of electronic monitoring services. The scheme was designed to prevent the MoJ from attempting to decrease G4S C&J’s revenues under those contracts. G4S C&J agreed to pay penalties and costs totalling £44.4 million. Additionally, the terms of the DPA bind G4S C&J to wide-ranging compliance obligations and improvements, including periodic review, assessment, and reporting of G4S plc’s and G4S C&J’s internal controls, policies and procedures by a third-party reviewer. These compliance obligations are a critical component of the DPA, offering substantial oversight and assurance regarding the future corporate conduct of a major UK government supplier.

- Entering into a DPA with Airline Services Limited (ASL) which requires ASL to pay over £2 million in financial penalties and disgorgement of profits. ASL accepted responsibility for three counts of failing to prevent bribery, arising from the company’s use of an agent to win three contracts, together worth over £7.3 million, to refit commercial airliners for Lufthansa. The company is also obliged to fully co-operate with the SFO and any other domestic or foreign law enforcement agency.

The SFO continued to attend court hearings throughout this difficult year using Her Majesty’s Courts and Tribunal Service Cloud Video Platform. We adapted our witness needs assessment questions to reflect the pandemic, talked to our witnesses and were able to offer those witnesses uncomfortable with traveling to central London the opportunity to give their evidence from home.

The SFO continued to investigate London Capital and Finance Plc, 3,825 victims in this case responded to our online questionnaire and all the victims identified as requiring help were successfully contacted and relevant support provided.

The SFO fully engaged with the Ministry of Justice consultation on the new Code of Practice for Victims of Crime published in April 2021, ensuring there was voice for victims in large complicated fraud cases. The SFO continue to work to improve the service we provide our victims and witnesses; we provide regular updates on case progression on our website; needs assess all those we contact; and, make sure victims have the access to the support they require.

The SFO continue to work to improve the service we provide our victims and witnesses

Proceeds of crime and international assistance

The Proceeds of Crime and International Assistance Division predominantly uses powers under the Proceeds of Crime Act 2002 (POCA) in pursuit of criminal funds through restraint, confiscation and civil recovery action. These include: Unexplained Wealth Orders, Account Freezing and Forfeiture Orders. The Division also provides assistance to overseas authorities by freezing and confiscating assets in the UK on their behalf.

Despite challenges arising from the Covid-19 pandemic on court processing times, the team continued to work in pursuit of individuals and corporates to recover the proceeds of crime and demonstrate their commitment to compensating victims. The team sought Confiscation Orders and the Court’s reconsideration of previous Confiscation Orders where further realisable assets were available. To that end we obtained Confiscation Orders valued at £5.6m. A total of £5.7m was recovered on orders this year and outstanding orders from previous years, with £200k paid as compensation to victims. The compensation was collected from Orders made in previous financial years. The SFO will seek Compensation Orders where there are victims; no Compensation Orders were sought during this year as there were no identifiable victims in the cases where Confiscation Orders were made.

The team continued to conduct Civil Recovery investigations involving applications to the High Court to show that, on the balance of probabilities, the assets being pursued were the proceeds of crime. Approximately £1.2m was recovered.

Proceeds of Crime

To illustrate our results below are some of our success stories:

- On 13 July 2020, two defendants were ordered to pay Confiscation Orders of £2.9m and £2.5m respectively. The former Chief Executive Officer and Chief Operating Officer of Afren, were each found guilty of one count of fraud and two counts of money laundering in October 2018.

- On 30 July 2020 SFO investigators successfully obtained an Account Forfeiture Order for £52k. In March 2019 the SFO commenced an Account Forfeiture investigation into money suspected to be recoverable property. The funds were being transferred by a defendant who was successfully prosecuted and convicted in 2018 for fraud offences. The defendant was transferring funds in respect of the purchase of a commercial property and was suspected to be deliberately bypassing the usual procedure of due diligence and money laundering checks by directly transferring funds directly to the vendor.

- In September 2020, the SFO obtained a Listed Asset order to recover over £500k worth of gold jewellery from the former partner of a convicted fraudster, on the basis that the jewellery was purchased either by the criminal or with the proceeds of his offending. The SFO’s criminal investigation showed how the fraudster, who fled to another jurisdiction before charges could be brought, and his brother, defrauded a number of mortgage advisors into providing mortgages totalling £49.3m for properties worth only £5.6m.

- On 29 October 2020, an Account Forfeiture investigation was opened and an account with £400k was frozen. The account was linked to the successful prosecution of a defendant who used a chain of third party corporates under his ownership or control to further the fraud of which he was convicted, one such company being based in Dubai. The company is no longer trading and the trading account is frozen awaiting forfeiture proceedings.

- On 13 November 2020 an out of court settlement was agreed between the SFO and a respondent for £1.2m plus £57k in costs. In November 2020, a civil recovery investigation linked to a UK property believed to be wholly or partly purchased with the proceeds of crime came to a conclusion. The property was owned by a Brazilian National who had entered into a plea agreement with Brazilian authorities in relation to bribery charges being brought against him. The SFO identified that £1.2m was used as part of the purchase funds for the property and was directly linked to criminality and therefore deemed recoverable funds. The settlement amount represented 24% of the value of the property.

- On 14 January 2021, the SFO successfully sought an increase in the original Confiscation Order of one defendant bringing the total confiscation amount to £270k. Following a conviction for conspiracy to defraud, in August 2011 the defendant was made the subject of a Confiscation Order where the benefit figures was £1.1m and the available amount £107k. The defendant was found guilty of running a high-pressure share-pushing scheme from Spain to defraud around 1,250 UK-based investors out of over £7 million. The SFO discovered that the realisable assets of the defendant were greater than previously thought and following a further investigation, an increase to the original Confiscation Order was sought. The full amount recovered will be used to compensate victims.

International Assistance

The SFO is able to use its powers under the Criminal Justice Act 1987 to obtain evidence for overseas investigations and prosecutions pursuant to incoming requests for Mutual Legal Assistance. This interaction with overseas investigators and judicial authorities furthers the SFO’s strategic objective to “develop, and strengthen, constructive relationships with partners both in the UK and internationally”.

A total of £5.7m was recovered on orders this year and outstanding... with £200k paid as compensation to victims

Intelligence

In 2020 our Intelligence Division undertook a series of threat assessments to enable us respond to the changing landscape of economic crime. Drawing on experience of staff and working across our Economic Crime (EC) partners ensures we are focused in the right places. By doing so, we will find the next generation of cases which represent the significant issues facing the UK as a global financial centre. These threat assessments have influenced the work of our partnership working groups and form an integral part of the annual work plans across the EC landscape.

We continue to prioritise the development of high quality intelligence to develop our cases and remain alive to emerging threats. We have set an ambitious strategy to achieve this over 2021/22 focused on four themes:

- international bribery and corruption in a changing world;

- the 2021 threat landscape;

- getting ahead of investment fraud; and

- the growth of Cryptocurrency.

By homing in on the information we want to collect and using it to best effect, we will bring forward the next generation of cases at the SFO.

We continue to prioritise the development of high quality intelligence to develop our cases

Case work quality

The Case Evaluation Board (CEB), Case Review Panels (CRP), a process of Peer Review and a Casework Assurance Framework formed the main elements of a robust quality assurance control process.

The CEB enables the Director to make an informed decision, based on its recommendation, to initiate or decline an investigation. The frequency of meetings is dependent upon the intelligence pipeline. During the year, the core membership was adjusted to take account of revised roles and responsibilities. Core members are General Counsel, the COO, the Chief Investigator and the Chief Intelligence Officer (CIO).

The purpose of the CEB is to:

- evaluate and challenge intelligence submissions against the Director’s Statement of Principle (which governs the basis upon which decisions are made as to which cases should be adopted for investigation);

- assess strategic and tactical risk, cost and resource implications; and,

- where appropriate, consider potential cases in the context of the Government’s strategic approach to economic crime.

CRPs ensure that an appropriate level of scrutiny and challenge is given to every case. The Terms of Reference are regularly reviewed to ensure that the Director is provided with assurance that:

- cases under investigation are being progressed at pace in an appropriate manner with a view to charging, discontinuance or other disposal;

- cases at the prosecution or post-trial stage are being prepared effectively for court in an appropriate manner;

- cases involving actual or anticipated civil litigation are being managed in a manner appropriate to the particular risks and issues arising;

- proceeds of crime matters are considered appropriately throughout the lifecycle of cases; and,

- appropriate consideration is being given at all stages of a case to the particular risks, challenges, resource requirements and legal or operational issues arising in that case.

CRPs are convened by General Counsel in consultation with the Chief Investigator as they deem appropriate, but with the aim that all cases are scrutinised at least twice per calendar year. A process of Peer Review was used during the year to provide assurance in relation to the investigation stage of our cases. It provided senior managers with an objective analysis of the approach taken in our investigations, highlighted areas for improvement and identified where good practice could be shared across all our case teams. Three Peer Reviews were conducted during the year.

The purpose of the Casework Assurance Framework is to ensure that, at regular intervals, Heads of Operational Divisions are provided with assurance that cases are progressing well and that any strategic areas of concern (specifically those identified either by way of a Peer Review or at the CRP) are being addressed.

The aim of the process is to:

- guard against investigative drift;

- ensure that the investigation is proceeding at a suitable pace;

- ensure that the gathering of evidence is ‘front loaded’ as much as possible;

- ensure that, as investigations progress and develop, they do so on the basis of informed hypotheses and admissible evidence; and,

- ensure adherence to approved professional practice, the standards set out in the SFO’s Operational Handbook and any other relevant SFO policies.

The SFO continues to measure its performance by demonstrating organisational learning at different levels throughout the operational and non-operational divisions. By sharing lessons learnt at different phases of the case life cycle, the SFO is able to ensure this informs the training strategy. The SFO’s Operational Handbook also provides a vehicle to ensure that we operate consistently and follow best practice. In light of the disclosure challenges in the Serco trial, we will be focusing and reviewing the Operational Handbook as part of the lessons learned exercise we are undertaking.

This will be reviewed as part of our lessons learned exercise on the recent trial of former Serco employees.

CRPs ensure that appropriate level of scrutiny and challenge is given to every case

Covid-19

The SFO continued to adhere to Government guidelines on working from home in order to stop the spread of Coronavirus and protect the NHS. Throughout the year, over c90% of our staff continued to work from home.

Our Contingency Planning Group which was set up to address the immediate issues and concerns from staff and to assess the effectiveness of our plans and the impact on our business continued to operate throughout the year. The group’s focus was to tackle immediate and emerging issues created by the new working environment which included supporting staff working at home, and those who continued attending the office, and maintaining the systems and technology needed to enable staff to maintain productivity.

We introduced video conferencing technology to enable staff working remotely to connect with colleagues and their teams and extended it to enabling core investigative activity such as section 2 interviews to be conducted remotely or by telephone. We kept our digital forensics capability operational throughout processing the material we need to maintain pace in our investigations.

We brought defendants to trial during the pandemic. We worked with colleagues in the Criminal Justice System and the courts to enable these trials to continue during the restrictions, supporting victims and witnesses who need to attend to give evidence whether in person or remotely. The SFO adapted its victim and witness needs assessments to establish the personal circumstances of witnesses in relation to the pandemic. In one trial, working closely with HMCTS, we were able to accommodate all the civilian witnesses giving evidence from home via the cloud video platform.

The SFO also established the Strategic Covid Planning Group (SCPG) as a forward-looking and horizon scanning group to provide strategic and tactical oversight, working to anticipate and proactively plan for:

- The operational work of the SFO;

- The health, safety and well-being of our staff;

- The recruitment and induction of new staff;

- The development of staff; and,

- Work with partners across government to share learning and understanding of the impact on our work.

The SCPG is also planning for the longer term, and the lasting impact of the pandemic on how we work with a commitment to hybrid working for staff, subject to business need, so that we can continue to deliver the SFO’s cases whilst offering flexibility to staff as to where they carry out their work.

EU Withdrawal

On 31 December 2021 the Transition Period that began when the UK ceased to be a member of the European Union on 31 January 2020 ended. At this point, a new Trade and Cooperation Agreement between the UK and the EU began. As our investigations often have significant international elements, it was essential that the SFO ensured that it was fully prepared for the outcome of the negotiations, in respect of EU law enforcement and judicial cooperation tools and measures, to ensure a smooth transition into the new relationship with the EU.

The SFO’s EU Exit team prepared the business for the potential outcomes at the end of the transition period by engaging with operational partners and other government departments throughout the transition period whilst conducting a full triage of the SFO’s casework, delivering bespoke advice to affected case teams and ensuring all transition considerations were taken into account in every relevant case. The result was that all EU tools and measures (such as European Arrest Warrants, European Investigation Orders, and Asset Freezing and Confiscation tools) that could have been operationalised prior to the end of the transition period were put into operation so that they would continue to be dealt with under the previous regimes as provided for by the terms of the UK-EU Withdrawal Agreement.

Stakeholder engagement and contributions to cross-Whitehall policy development

This year has seen the SFO build on its long-standing relationships with UK and international partners, at both strategic and operational levels. We have continued to maintain and strengthen these relationships and seek out new opportunities for collaboration despite the unique situation and challenges presented by the global Covid-19 pandemic.

In response to the pandemic, the SFO along with its partners modified our methods of engagement and collaboration. In doing this, we minimised the impact of the national and global restrictions, ensuring the SFO was able to actively contribute and influence in both domestic and international settings.

Domestically, the SFO has continued to support and contribute to the Government’s Serious and Organised Crime (SOC) Strategy. We are part of the law enforcement led delivery of the Government’s Economic Crime Plan (ECP) objectives, and the collaborative work on the fraud reform programme. The SFO contributes to the overall governance to combat economic crime through participation in the Economic Crime Strategic Board, jointly chaired by the Home Secretary and the Chancellor, which is supported through the Economic Crime Delivery Board coordinating work across HMG. Through this, the SFO is able to carry out its niche role within the criminal justice system of investigating and prosecuting the top tier of serious or complex fraud, bribery or corruption, whilst ensuring our expertise and work also supports the delivery of ECP and SOC strategies and objectives.

Recognising the SFO’s role in the economic crime landscape the Director participated in a number of events this year including a Royal United Services Institute webinar giving a keynote speech on future challenges in economic crime, and the Trace International Virtual Forum Q&A panel focussing on the SFO’s insights on enforcement trends and priorities in the UK.

In addition, as an established and experienced law enforcement agency, the SFO continues to contribute to the cross-Government response to Covid-19 related public sector funding frauds and the newly emerging associated fraud threats (PPE mis-selling and vaccine supply) alongside key government and law enforcement partners.

The SFO has been consulted on, or contributed to, a diverse range of legislative and cross-Whitehall policy developments relevant to our work. These include reviews of the legislative frameworks governing the investigative and prosecutorial powers we use such as pre-charge bail; disclosure in criminal cases; and covert human intelligence sources. Through these, we have successfully influenced legislative amendments that will enable the SFO to continue to deliver justice fairly and more effectively, by better equipping us with tools and powers that are commensurate to the complexity of our casework.

Alongside maintaining relationships with Law Enforcement partners, Whitehall departments, Ministers, and policy leads, the SFO also has a role in supporting parliamentary committee work. The Director met with the All Party Parliamentary Group (APPG) on Whistleblowing to discuss the UK’s whistleblowing framework and the relationship of the framework with the SFO’s work.

The SFO works closely with the AGO to ensure both the Law Officers and parliament are kept informed of SFO work and progress. Key avenues of parliamentary scrutiny include Attorney General’s Questions, Justice and Treasury Select Committees, where parliamentarians regularly examine our work and delivery, and are able to ask or table (at AGQs) questions about our work, progress and results. We regularly support these with facts, information and briefings as required.

Additionally, we continue to engage with the Law Commission on reviews relevant to our core business such as its review of the Proceeds of Crime Act confiscation regime. Through this, we provided operational insight and guidance on the SFO experience of the work within the current regime and any challenges identified.

Having played a significant role in the establishment of the NECC, two years on the SFO considers the NECC a key strategic and operational partner. The SFO continues to actively contribute the NECC, not only through SFO seconded staff, but through working more closely with NECC partners, including the City of London Police and the NCA to ensure casework is joined up, and that we are using our skillsets to the fullest. We remain committed to delivering justice effectively and believe that this will be achieved by working together through a true multi-agency approach. This is exemplified through the SFO’s contribution to the NECC’s national law enforcement campaign Operation Otello targeting high-harm frauds, that includes Operation Giantkind, a focus on investment fraud.

Relations with UK law enforcement and regulatory partners have been further enhanced through our contributions to various cross-government tactical and operational forums, including threat, delivery and working groups and regular bilateral meetings. The SFO continues to co-chair the multiagency Bribery & Corruption Sanctions Evasion Threat Group. These activities are underpinned by Memorandums of Understanding or operational protocols where necessary. Our commitment to joint working and information sharing has directly benefited a number of active SFO investigations, as well as those of partner agencies.

The SFO’s role in fighting corruption continues to develop and expand. We are committed to supporting the work of Home Office’s Joint Anti-Corruption Unit including as an active member of the UK’s delegation at the Organisation for Economic Co-operation and Development’s (OECD) Working Group on Bribery. Recognising the SFO’s skill and experience, we were an integral member of the lead assessment team for the OECD Working Group on Bribery’s Phase 4 evaluation on the United States’ implementation of the OECD’s Convention of Combatting Bribery of Foreign Public Officials in International Business.

The SFO as the only UK law enforcement agency to utilise the DPA as a prosecution tool, has provided increased support and guidance to other jurisdictions seeking to develop a similar framework. This is in addition to having published in redacted format our revised internal guidance Operational Handbook chapter on DPAs, to help share expertise and expand the knowledge and understanding of interested stakeholders.

Through virtual methods, we have delivered training and information sessions focussed on capability building through sharing our expertise with criminal justice partners including Australia, Indonesia, Singapore, Mexico and South Korea. This is in addition to participation in International Law Enforcement Networks (LEN) such as the Latin America and Caribbean Anti-Corruption LEN to share experience.

Digital and technological capability

A key focus for this year has been enhancing our technology provision to meet the challenges of the pandemic and remote working. This included implementing new video conferencing capabilities to improve remote collaboration and increasing our network capacity and resilience. We have adapted our technology support model to meet the challenges of supporting a more dispersed workforce. We have also developed solutions to support new ways of working across the organisation, for example enabling interviews to be carried out remotely.

Our Digital Forensic unit has continued to provide a vital flow of evidence to case teams despite restrictions on office attendance due to the pandemic. During this year we have continued to build our skills and capabilities, implemented process improvements and made greater use of automation. We plan to further enhance our capabilities in this area in the next financial year. We processed over 7.3 million items* this year.

This year we have focussed on moving our cases from old systems to newer systems that have better functionality. This will allow teams to benefit from the advanced analytical capabilities provided by our e-Discovery platform.

We continue to evolve our Information Governance through a new framework of policies, roles and responsibilities for information risk management. Updated guidance and e-learning on handling personal data has also been issued to all staff this year, including in response to the pandemic, as well as changes to the international data transfer regimes throughout the withdrawal from the EU. We continue to work closely with law enforcement partners and policy leads in and across government around international data sharing post-EU exit. We continue to select historical case and corporate records for preservation at The National Archives in line with the Public Records Act 1958.

We have adapted... to meet the challenges of supporting a more dispersed workforce

Our people

The SFO strives to be an employer of choice with effective, highly-skilled, capable and motivated employees. Our approach to building and maintaining an effective workforce, and treating our people fairly and with respect and dignity, is measured to an extent through our participation in the Civil Service People Survey. Our engagement score in 2020 was 62%, a slight reduction of 1% compared with 2019. We have seen success with our drive to promote greater inclusion and fair treatment in the SFO with a reduction in discrimination, bullying and harassment. We will continue striving to create an inclusive and fair organisation for all staff. One of our commitments is to improve the leadership and management of the SFO. This year we saw a 7% increase overall in this area. Notably, there was a 16% increase in relation to visibility of senior leaders and managers.

All civil servants are entitled to five days of learning and development each year. During 2020-21, SFO staff undertook 1,757 days of training which equates to an average of 3.67 days per person, as compared with an aspirational target for all staff to receive 5 days learning per year. We are focussing on doing more in this area after a drop in our People Survey results. This includes a new leadership and management development portfolio offering for all staff to improve their leadership and management capabilities, through a guided learning package.

As part of our commitment to developing our people and in response to a leadership inspection carried out by HMCPSI, in 2019 the Director launched a three year Culture Change Programme.

The programme has four key objectives:

- Implement Effective Organisational Development to deliver the SFO’s vision. Ensuring staff feel valued and supported by having adequate resources and information available to get their jobs done.

- Create a balanced effective workforce fairly reflecting the Roskill Model by recruiting and retaining the right people, at the right grades and disciplines to deliver high quality outputs.

- Improve and maintain learning and development opportunities for all to enhance staff careers and further develop their skills.

- Support improvements in staff wellbeing to offer an excellent staff experience at work and become an employer of choice.

To ensure our workforce has a meaningful stake a number of trusted representatives were chosen by SFO staff to form the group overseeing the programme and we are continuing to develop a series of training and development programmes to support staff at all levels.

Successes so far include:

- completing the roll-out of a Talent Management Programme to all staff. Talent management discussions are now part of the routine annual management cycle;

- launching a new Professional Qualifications and Supplemental Training Policy to support those staff looking to attain professional qualifications;

- appointing a further eleven trainee investigators to our trainee programme;

- appointing three apprentices on Business Administration apprenticeships;

- launching an on-line GP service to provide staff with access to GP services 24/7;

- appointing four new Mental Health Allies to provide support to colleagues with mental health issues;

- launching a new Dispute Resolution Policy with the focus on resolving issues between staff and to help to create a more harmonious working environment;

- training two staff as mediators to support in resolving issues between colleagues;

- launching a “simply thanks” scheme to recognise contributions made by colleagues;

- launching a new Gender Identify and Intersex policy to support all colleagues in relation to gender identity issues; and

- launching a new training initiative using Action Learning Sets for our Band A leaders and managers with the aim of giving Band A’s confidence to address complex issues by discussing these in a supportive group environment to produce new ideas.

We have a formal consultation framework with three recognised Trade Unions: the First Division Association (FDA); Prospect; and, the Public and Commercial Services Union (PCS) and continue to engage constructively with all of them on a wide range of matters.

The 2020-21 pay award was delivered on the basis of a performance matrix enabling top performing staff to move up the pay bands more quickly than other colleagues. Eligible staff received awards of between 1% and 2.8%.

One of our commitments is to improve the leadership and management of the SFO

Financial Performance

HM Treasury sets the budgetary framework for government spending. The total amount a department spends is referred to as the Total Managed Expenditure (TME) which is split into:

- Departmental Expenditure Limit (DEL)

- Annually Managed Expenditure (AME)

As part of spending review, which normally occurs every three to five years, HM Treasury set limits for DEL budgets, as DEL budgets are understood and controllable. AME budgets are agreed with HM Treasury each year, as these capture spending which is more volatile or demand led.

In addition to being split into DEL or AME, department’s budgets are also split into Resource or Capital categories. Resource budgets capture current expenditure (including depreciation, which is the current cost associated with fixed assets, and is ringfenced) whilst Capital budgets capture new investment and financial transactions.

Further analysis of budgets is between Programme and Administration costs. Programme budgets capture expenditure on front line services. Administration budgets capture any expenditure not included in programme budgets, such as enabling functions, rent and IT. They are controlled to ensure that as much money as practicable is available for front line services.

The SFO’s Resource DEL outturn for the year totals £65,477k against a voted limit of £66,877k, an underspend of £1,400k. Capital DEL was underspent by £2,361k.

The Department has incurred an Excess of £2,550k as a result of costs being incurred in the Serco Geografix Limited case. As referred to on page 18, two individuals were charged in December 2019 in connection with the Serco case and the trial commenced on 29 March 2021. On 26 April 2021 the SFO offered no evidence at their trial after a review of the disclosure process. The judge directed the jury to return verdicts of not guilty and the SFO accepted liability for reasonably wasted costs in respect of the trial. The incurring of the costs has been treated as an event after the reporting period and an adjustment made in the accounts. As a result, there was no opportunity to request budgetary cover and the Voted Resource AME control total has been exceeded, resulting in a qualified audit opinion and an Excess Vote. The Department will seek parliamentary approval by way of an Excess Vote in the next Supply and Appropriation Act.

The 2019 Spending Round, set the SFO’s financing for 2020-21and renewed the principle that access to Reserve funding will continue to be a part of the SFO’s settlement for those cases where costs are above £2.5m (5% of non-ringfenced DEL). This additional financing will continue to be agreed with HM Treasury on a year by year basis and confirmed in the Supplementary Estimate.

The net Resource DEL has increased by £13.5m since the Main Estimate was agreed. Of the increase, £9m is attributed to cases which will cost above £2.5m for the year.

Sustainability

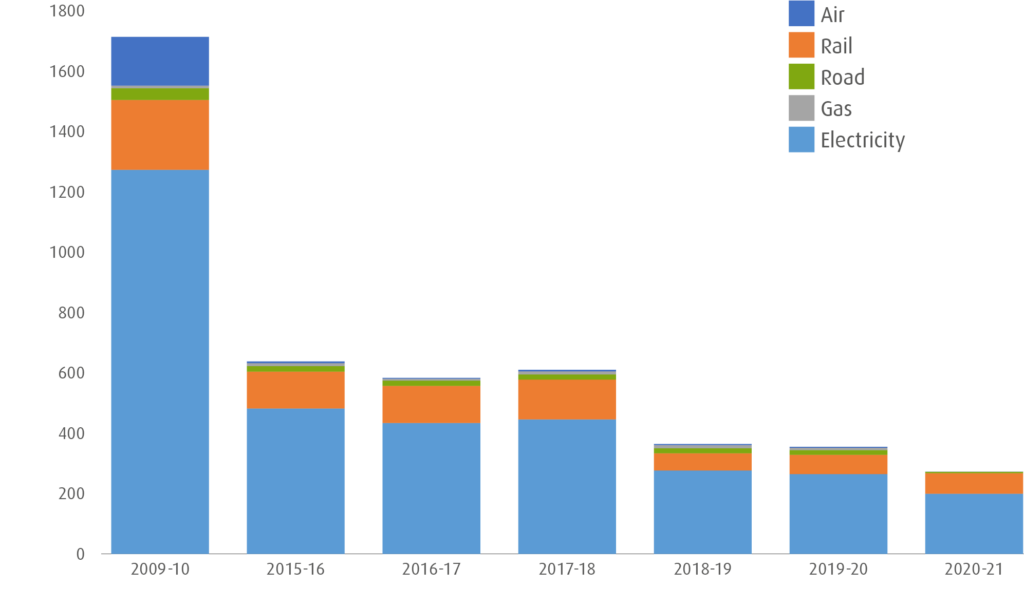

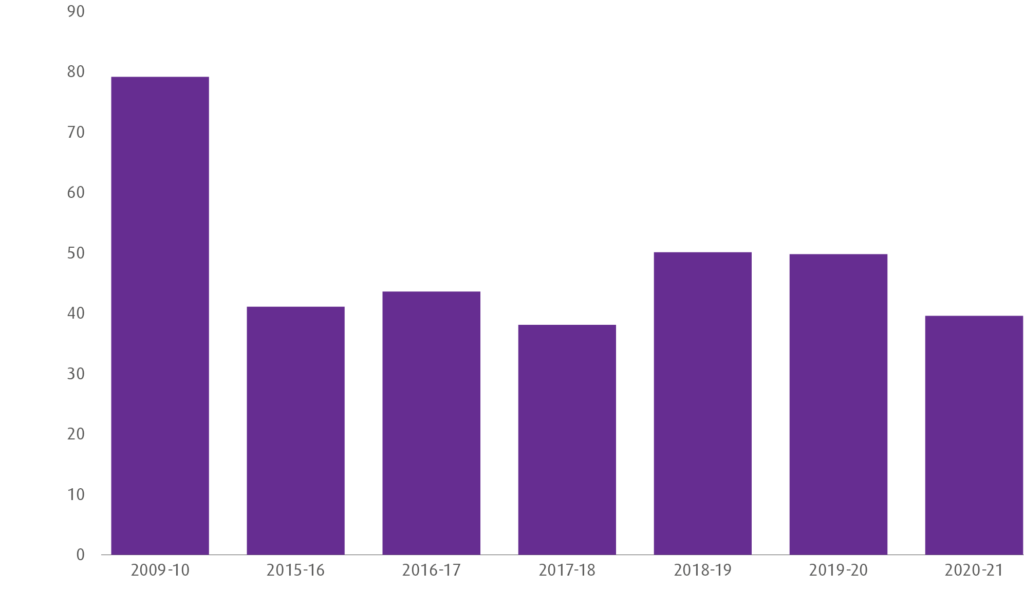

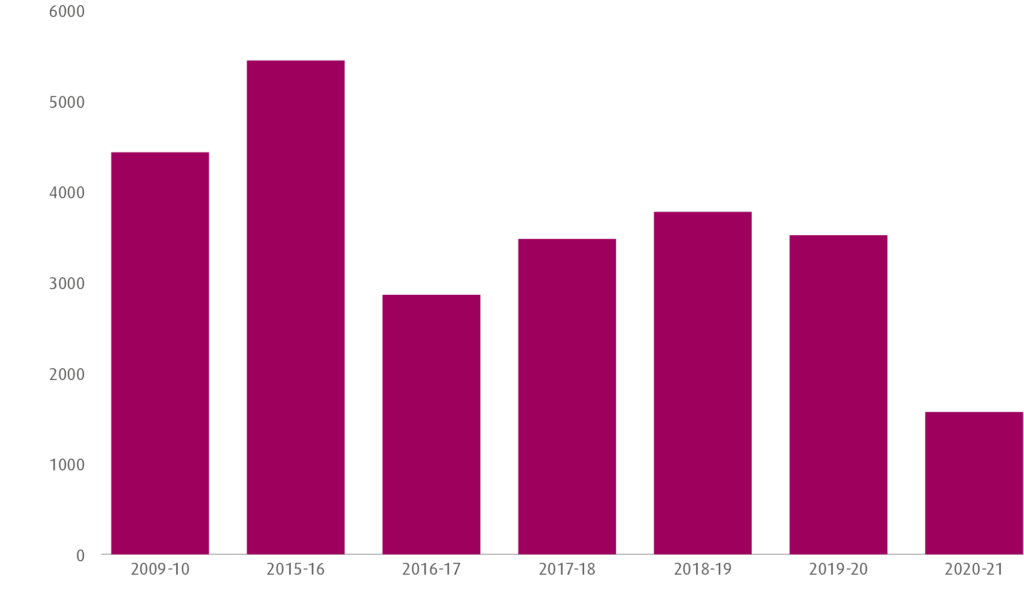

The SFO is committed to government policy to improve sustainability and is working towards meeting the Greening Government Commitment (GGC) targets which started on 1 April 2011 with a baseline period of 2009-10.

Information on SFO progress can be found at page 120.

Lisa Osofsky

Accounting Officer

9 July 2021

Corporate Governance Report

Director’s report

The Governance Statement on page 41 sets out the governance, risk, assurance and internal control framework. The SFO’s governance arrangements are implemented in line with HM Treasury’s and Cabinet Office’s Code of Good Practice for Corporate Governance.

We are an Arm’s Length Body that is sponsored by the Attorney General’s Office (AGO), the formal relationship and responsibilities between the AGO and SFO are set out in a Framework Agreement which was published on 21 January 2019. Throughout 2020-21 we have developed a governance framework that will hold the responsibility of overseeing, challenging and managing the risks to the delivery of our organisational objectives. Within this framework, the SFO Board is the senior governance body supported by a series of committees and groups.

Departmental assurance process on management of interests and business appointments

The SFO has a policy for the declaration and management of interests in place for all staff. This policy aims to ensure that all staff are able to recognise any potential conflict of interest and ensure that this does not affect, or appear to allow their judgement or integrity to be compromised. The policy exists to protect the Serious Fraud Office and its investigations and prosecutions and adheres to the requirements of the Civil Service Management Code (section 4.3).

It also ensures that any outside employment held by Senior Civil Servants does not present a conflict of interest.

In particular:

- All staff are required to complete a ‘Register of Interests’ form as part of the SFO recruitment checks, whether they have a conflict of interest or not.

- All staff are required to re-submit the Register of Interest form whenever their circumstances change.

- All staff must declare any new conflicts as part of the annual security appraisal process or if circumstances change.

There is also a mandatory requirement for all staff to complete Conflicts of Interest training annually.

Personal data related incidents

One personal data breach was reported to the Information Commissioner’s Office (ICO) in the accounting period. The ICO decided there was no further action needed on the matter. There were 49 non-reportable data-related incidents recorded.

We conducted an exercise to understand how the breach occurred and subsequent new controls have been embedded to mitigate a recurrence of this particular type of breach which now requires additional manual confirmation steps before information is released.

Auditors

The Serious Fraud Office’s Accounts are audited by the National Audit Office (NAO) on behalf of the Comptroller and Auditor General. No further assurance or other advisory services were provided by the auditors.

Remuneration to auditors for non-audit work

The SFO did not pay any remuneration to its auditors for non-audit work. The notional fee for the audit of the Department’s Accounts for 2020-21 was £55,000, (2019-20: £50,000), and £5,000 (2019-20: £5,000) for the audit of the Trust Statement.

Corporate Governance Report

Under Section 5(2) of the Government Resources and Accounts Act 2000 HM Treasury has directed the SFO to prepare, for each financial year resource accounts detailing the resources acquired, held or disposed of during the year and the use of resources by the Department during the year. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the SFO and of its net resource outturn, application of resources, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

- make judgements and estimates on a reasonable basis;

- state whether applicable accounting standards, as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts; and,

- prepare the accounts on a going concern basis.

HM Treasury has appointed the Director of the SFO as Accounting Officer of the SFO. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the SFO’s assets, are set out in Managing Public Money published by the HM Treasury.

The Accounting Officer has taken all the steps that she ought to have taken to make herself aware of any relevant audit information and to establish that the SFO’s auditors are aware of that information. So far as the Accounting Officer is aware, there is no relevant audit information of which the SFO’s auditors are unaware.

The Accounting Officer confirms that the annual report and accounts as a whole are fair, balanced and understandable and that she takes personal responsibility for the annual report and accounts and the judgements required for determining that it is fair, balanced and understandable.

An Additional Accounting Officer has been appointed for instances where the Director is not available. This arrangement has not been called on this year.

Governance statement

Scope of responsibility

This statement covers the SFO’s governance arrangements for the year ended 31 March 2021 for both the Departmental Resource Accounts and the SFO’s Trust Statement at page 99.

The Director is responsible for the discharge of the organisation’s functions through the SFO’s Board, Executive Committee (which replaced the Executive Group in November 2020), Audit & Risk Committee and other supporting governance forums. She is supported by the SFO’s Chief Operating Officer (COO) who has responsibility for overseeing the organisation’s operational work and the Chief Capability Officer (CCO) who has responsibility for the full range of corporate and technology functions, and acts as catalyst and sponsor for new initiatives. In the last Annual Report and Accounts it was noted that the Director created the CCO role and Michelle Crotty was appointed in August 2020.

The Director is responsible for maintaining a sound system of internal control, which supports the achievement of the SFO’s aims and objectives and compliance with its policies. The Director is also charged with safeguarding public funds and Departmental assets, for which she is personally responsible, in accordance with the responsibilities assigned to her in Managing Public Money.

Governance structure

A Framework Agreement published in January 2019 sets out the relationship between the Law Officers and the Director. This relationship is an essential component of our governance. In accordance with the sponsorship and statutory superintendence arrangements, the Director meets with the Law Officers regularly. The Framework Agreement describes the Ministerial Strategic Board (MSB) which meets three times per year. The Board’s overarching aims are to oversee the strategic direction for the SFO and to hold the SFO to account for delivery of its strategic objectives. Other responsibilities include supporting the roles and responsibilities of the Law Officers and the Director, agreeing and supporting the SFO’s engagement priorities and reviewing financial management, performance and efficiency.

The MSB is chaired by the Attorney General or the Solicitor General and its membership comprises the Law Officers, the Director, the Director-General (AGO), the COO, and an appropriate non-executive director. The CCO, Chief Financial Officer and the Chief Inspector of HM Crown Prosecution Service Inspectorate also attend as required.

The Attorney General’s superintendence extends to matters encompassing SFO casework. Regular superintendence meetings are held between the Attorney General and Director of the SFO to discuss cases which are particularly sensitive, or have the potential to set precedent or hold implications for prosecution of criminal justice policy. These meetings are designed to provide assurance to the Law Officers on the appropriate decision making of the SFO in its casework. Any other meetings are convened as required between the Law Officers and the Director of the SFO.

Committee structure

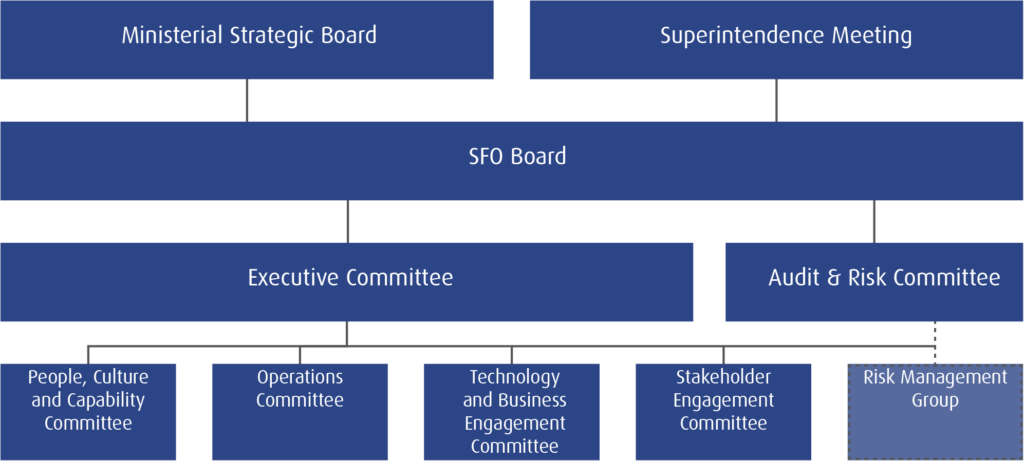

The SFO’s governance arrangements are in line with HM Treasury’s and Cabinet Office’s Code of Good Practice for Corporate Governance. The three main governance forums are the Board, the Executive Committee and the Audit and Risk Committee. There are also four sub-committees which support the Executive Committee in achieving the SFO’s objectives across our four priority areas (Operations, People, Stakeholder and Technology). Alongside this, there are a number of supporting working groups, all of which feed into the work and responsibilities of at least one of the main governance forums.

In April 2020, our governance was revised to establish four committees, with delegated authority from the Executive Group (now Executive Committee), to provide clear governance of the SFO’s key priorities – Operations, People, Stakeholders and Technology.

These four committees are the:

- Operations Committee;

- Stakeholder Engagement Committee (formerly the Strategy and Engagement Committee);

- People, Culture and Capability Committee (formerly the People and Culture Committee); and,

- Technology and Business Engagement Committee.

The work of the Executive Committee and its sub-committees is supported by a number of working groups set up to address specific issues or to update processes and practice within the SFO. Such groups cover areas including equality and diversity, the Operational Handbook, training, evidence handling, victims and witnesses and community engagement and charities. These groups are aligned under the governance of the relevant committee to provide oversight, risk assurance and quality control.

The membership of the Board, Executive Group Committee and Audit and Risk Committee is set out in the tables below, and the purpose and arrangement of these forums is contained in the succeeding sections. The membership of the Board, Executive Committee and Audit and Risk Committee is set out in the tables below, and the purpose and arrangement of these forums is contained in the succeeding sections.

Executive

Lisa Osofsky

Director

Lisa Osofsky began her career working as a US federal prosecutor, taking on white collar crime cases including defence contractor and bank frauds, money laundering and drug related conspiracies. She spent five years as Deputy General Counsel and Ethics Officer at the FBI and was seconded to the SFO whilst a Special Attorney in the US Department of Justice’s Fraud Division. She was also called to the Bar in England and Wales.

Lisa has worked for Goldman Sachs International as their Money Laundering Reporting Officer and spent seven years in the Corporate Investigation Division of Control Risks, where she advised on compliance issues. Prior to joining the SFO in August 2018, Lisa worked for Exiger, a global governance, risk and compliance advisory firm, where she served as Regional Chair and Head of Investigations for Europe, Middle East and Africa.

Attended:

7 out of 7 Board meetings as Chair in 2020-21

3 out of 3 Audit and Risk Committee meetings in 2020-21

John Carroll

Chief Operating Officer

John Carroll joined the Serious Fraud Office in June 2014 as Head of Law Enforcement Liaison and International Assistance. His permanent appointment as Chief Operating Officer was confirmed in May 2020.

John has over 35 years’ law enforcement experience in HM Revenue & Customs, the Ministry of Defence and the police, both in the UK and Hong Kong.

Attended:

7 out of 7 Board meetings in 2020-21

3 out of 3 Audit and Risk Committee meetings in 2020-21

Sara Lawson joined the Serious Fraud Office in May 2019 as General Counsel. Formerly of Red Lion Chambers, Sara is a barrister with extensive experience prosecuting government, criminal and regulatory cases.

Attended:

7 out of 7 Board meetings in 2020-21

Michelle Crotty

Chief Capability Officer from 10 August 2020

Michelle Crotty joined the SFO in August 2020 from her role as Director of Strategy at the National Crime Agency. Michelle has spent the last 14 years working in a range of government departments including as Director at the Attorney General’s Office and Deputy Director at the Sentencing Council, an Arm’s Length Body of the MoJ. Prior to entering the civil service she was a partner in a leading London legal aid practice

Attended:

4 out of 4 Board meetings in 2020-21

2 out of 2 Audit and Risk Committee meetings in 2020-21

Liz Corrin

Chief Financial Officer

Liz Corrin joined the Serious Fraud Office in April 2019 as Head of Corporate Services. Her previous post was at the Government Internal Audit Agency where she held a similar position. Liz has also worked at the Office of Rail and Road, Department for Transport, HM Treasury and in the private sector. She is a Fellow of the Institute of Chartered Accountants in England and Wales.

Attended:

7 out of 7 Board meetings in 2020-21

3 out of 3 Audit and Risk Committee meetings in 2020-21

Non-Executive Directors

Martin Spencer was appointed in March 2019. Martin has a background in economics, business leadership and IT consulting. Martin has held a number of leadership roles in both the UK and across Europe with KPMG Consulting and Capgemini. He was previously a Director at Detica where he consulted on international business, technology, data analytics and fraud detection. Martin also sits as a non-executive director on the boards of the Education and Skills Funding Agency, the NHS Counter Fraud Authority and joined the Audit Committee of the London Fire Brigade.

Attended: 7 out of 7 Board meetings in 2020-21

3 out of 3 Audit and Risk Committee meetings in 2020-21

Sanjay Bhandari

Sanjay Bhandari was appointed in July 2019. Sanjay had a 29 year career in professional services. He spent the first 15 years of his career as a lawyer specialising in fraud and white collar crime at Herbert Smith Freehills and Baker McKenzie. He then had a number of leadership roles in forensic technology, compliance and innovation at KPMG and EY, where he was a Partner for 12 years before taking up a portfolio career as an independent board member, adviser and charity trustee. Sanjay is also an active and recognised leader of Equality, Diversity and Inclusion strategies. He is a member of the government sponsored Parker review on ethnicity on UK Boards and is Chair of Kick It Out, English footballs leading equality and inclusion charity.

Attended: 6 out of 7 Board meetings in 2020-21

3 out of 3 Audit and Risk Committee meetings in 2020-21

Emir Feisal was appointed in March 2019. Emir is a Chartered Accountant and Fraud Examiner and spent the majority of his career as Associate Managing Editor at the Sunday Times where he was responsible for the organisation’s finances. Alongside his non-executive director commitment, Emir sits as a Commissioner for the Judicial Appointments Commission, and as a Presiding Justice in the Adult Court. Emir also sits as a Committee member on the Public Service Honours Committee and, is a Board member at the Driver Vehicle Standard’s Agency and The Pension Ombudsman.

Attended: 7 out of 7 Board meetings in 2020-21

3 out of 3 Audit and Risk Committee meetings in 2020-21

Magnus Falk

Magnus Falk was appointed in July 2019. Magnus spent most of his career developing ways to exploit technology to improve business performance, first at Accenture and later at Credit Suisse, where his last role was Managing Director and Chief Information Officer for EMEA countries. He served as deputy Chief Technology Officer to the UK Government in 2014-15. More recently he has served on the boards of a bank and a data centre provider as well as being a Senior Advisor to the Financial Conduct Authority. He is currently a CIO advisor at Zoom.

Attended: 7 out of 7 Board meetings in 2020-21

3 out of 3 Audit and Risk Committee meetings in 2020-21

The Board

The Director chairs the Board and its membership additionally comprises the COO, CCO, General Counsel, CFO and the four non-executive directors.

In 2020-21, the Board met seven times. The Board is the SFO’s principal forum that sets the strategic direction and provides the senior leadership for both the corporate and operational functions of the SFO. In the previous year, the Director put in place arrangements to increase the number of non-executive directors from three to four with the intention of enhancing the degree of independent scrutiny and challenge to the Board and SFO business delivery processes.

The Board specifically:

- sets the SFO’s vision, mission, direction and values;

- sets the priorities for the SFO’s Strategic Plan and approves it;

- sets the priorities for the SFO’s annual Business Plan and approves it;

- monitors progress against the Strategic Plan and annual Business Plan;

- reviews the Annual Report and Accounts;

- ensures strategic and operational functions are performing effectively, efficiently and delivered in an ethical manner;

- approves the SFO’s annual budget;

- provides independent, effective and robust challenge to the Executive Committee as appropriate / holds members to account for operational delivery;

- oversees SFO Performance (immediate and future objectives);

- considers ways to improve performance (value for money);

- sets the priorities for strategic engagement with the SFO’s partners/stakeholders;

- monitors the SFO’s external reputation and its relationships with key stakeholders.

Working practices have been agreed so that the Board can discharge its responsibilities effectively. These practices deal with the cycle of meetings, setting agendas, the timetable for distributing papers and communicating decisions.

The Board aims to reach decisions by consensus. In exceptional cases, however, a decision may be taken by the Director alone because of the Director’s ultimate personal responsibility for the SFO as Accounting Officer.

In addition to this formal role, there are other occasions when the Board may meet to discuss important issues that could affect the SFO’s strategy, results or performance. An example of this are the series of senior leadership away days which were across January to March 2021. This series of away days was scheduled to discuss the SFO’s future ambitions including refreshing our mission, priorities and strategic objectives for the coming years, to set the foundation to build a new strategic plan for 2022-23 onwards.

Cabinet Office and HM Treasury’s Code of Good Practice for Corporate Governance cites a nominations and governance committee as good practice. Because the SFO is a small, non-ministerial department, the Board does not consider that a separate nominations and governance committee is necessary. Instead, the Board carries out the nominations and governance function as part of its normal terms of reference.

Executive Committee

In November 2020 the Executive Group agreed to create a new weekly Executive Committee made up of the Director, COO, CCO and General Counsel to replace the Executive Group with increased clarity and accountable leadership at the top of the SFO. The Committee meets weekly to allow for strategic decision making in a more agile manner. It is the principal senior management authority responsible for delivering the SFO’s Strategic Plan effectively, efficiently and economically through its Business Planning process.

The Executive Committee (ExCo):

- Provides assurance to the Board on implementation of the SFO’s Strategic Plan;

- Is accountable for delivery of the SFO’s Business Plan by reviewing, challenging, and scrutinising performance against the Business Plan and taking appropriate action to ensure successful delivery;

- Assures the Board, through its Audit and Risk Committee that controls are in place, fit for purpose and are operating as intended;

- Ensures the SFO’s core values are embedded within the culture of the organisation with support of the Culture Change Programme;

- Develops and communicates strategic plans and decisions;

- Delegates regular operational oversight and decision making arrangements to the four supporting Sub-Committees (People, Stakeholder, Technology and Operations) and that they escalate issues as necessary in accordance with their roles and responsibilities;

- Oversees the work of and decides upon matters escalated by Sub-Committees or Divisions; and

- Ensures sound financial management and scrutiny to achieve business objectives.

The Executive Committee aims to reach decisions by consensus. In exceptional cases, however, a decision may be taken by the Director alone because of the Director’s ultimate personal responsibility for the SFO as Accounting Officer.

In addition to this, there are other occasions when the Executive Committee may meet to discuss important issues that could affect the SFO’s strategy, results or performance.